Fractals, Mandelbrot & Financial Market

- Lepus Proprietary Trading

- Sep 13, 2019

- 3 min read

The fractal market hypothesis was introduced as the foundation of technical analysis which simply states that the markets are fractal in nature and that trends which appear on the higher time frames i.e Daily charts, can also occur on the lower time frames i.e 15 minute charts. This theory falls in the framework of chaos theory with the idea that fragmented geometric shapes when broken down into smaller segments, replicate and form the shape of the whole.

One of the ways fractals can be visualised is through the Mandelbrot set. This is a set of complex numbers which remain stable between the values -1 and 1 on an x and y axis. In other words, if you were to take any number between these two values and square root it then the result would move closer to 0.

i.e -0.752 = 0.5622 = 0.3162 = 0.1002 = 0.010 etc. Unstable numbers are outside this range, i.e 1.752 = 3.062 = 9.372 = 87.962 = 7,737.002 etc. Adding then a constant term to any number in the stable range (-1,1) changes where the stable and unstable points are inside this range, and the boundary inside of the range -1,1 then becomes a mixture of both stable and unstable values. You can also do this with then adding any constant inside the range -1,1 on both the X and Y axis to find which points are stable and unstable.

i.e 0.75^2 + 0.20 = 0.76, 0.76^2 + 0.20 = 1.36, 1.36^2 + 0.20 = 2.04, 2.04^2 + 0.20 = 4.392 … Infinity (unstable) i.e 0.35^2 + 0.20 = 0.32, 0.32^2 + 0.20 = 0.30, 0.30^2 + 0.20 = 0.29, 0.29^2 + 0.20 = 0.285 … Zero (stable)

You can see on the top the number constantly increases eventually towards infinity and below eventually towards zero when adding a constant (i.e 0.20 but can be any number between -1,1).

In mathematics this can simply be written as the term Zn + 1 = Zn^2 + C.

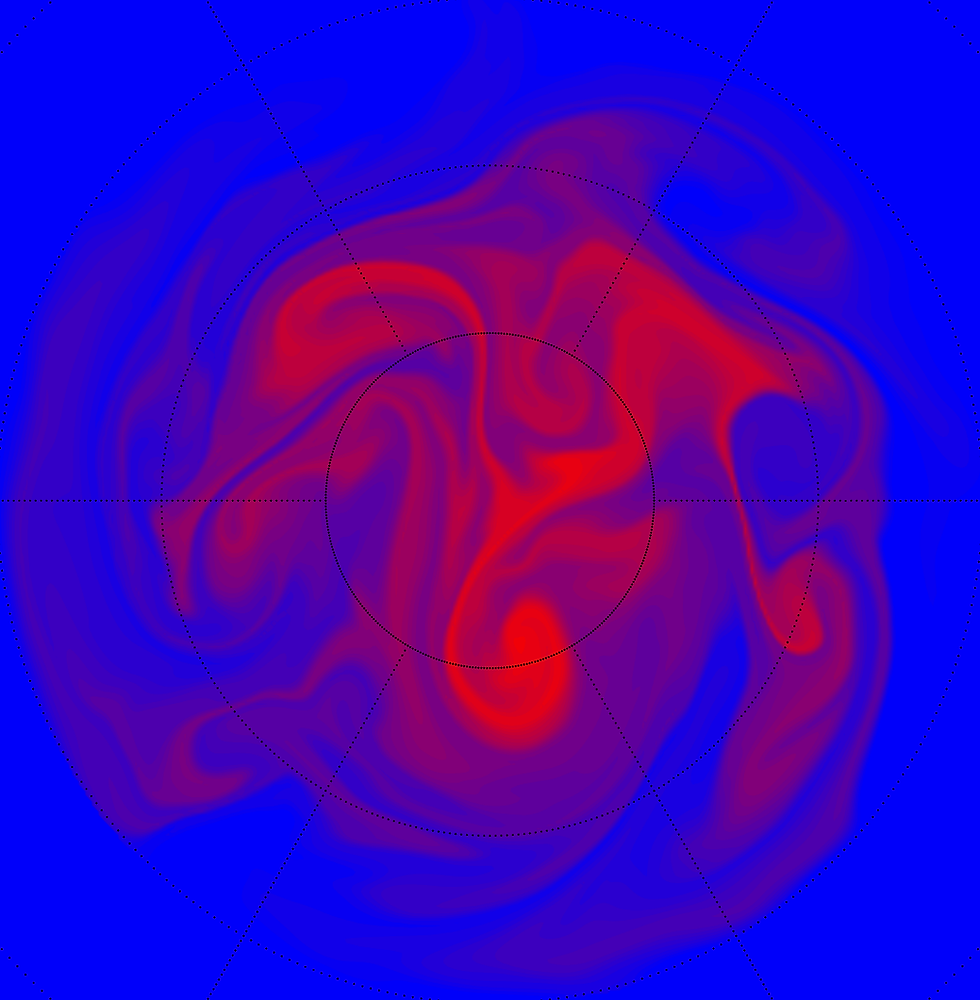

Knowing this, in 2001 a French mathematician named Benoit Mandelbrot thought to test, starting at the constant 0 each time and only adding the constant to the equation and then shading the points on the x,y graph that were stable and unstable in a different colour in terms of how unstable they are based on the amount of calculations (Iterations) that are done to find out if the number still approaches zero. For example, if the number calculated is still between -1,1 after 200 calculations then it is considered stable (black) and the colours indicate the point is unstable. The colour of the unstable points are based on the amount of iterations i.e how many calculations are need to be done before the number becomes unstable and it can be seen that the number goes to infinity.

Eventually you will arrive at a picture like this:

Beginning at C = 0 in the term Zn + 1 = Zn2 + C, will give you a circle, which states the boundaries of which set of numbers are stable and unstable. This was explained earlier with any numbers between the range -1,1 and can be simply visualised below which is known as the basic Julia set at C = 0:

Any variation of C beginning from the number 0 results in an alternative region which is not particularly a circle. These regions are known as Julia sets.

When selecting any constant in the regions of the Mandelbrot set – you can zoom in to find that exact point is similar to the Julia set, which makes up the shape of the Mandelbrot set as a whole. This can best be interpreted as a magnifying glass when held over the Mandelbrot set where inside every Mandelbrot set is an infinite number of Julia sets.

Best put in Mandelbrot's words, "Fractal mathematics cannot predict outcomes that result from complex adaptive systems but they can tell us that such outcomes will inevitably happen sometime. All one can do then is prepare for their arrival and wait". This approach is tied to trading financial markets in the sense that probability is the best approach there is to tackling chaos and ultimately put the odds of success in your favour.

Comments