Trading and Chaos: Why the Market Turns Grey

- Lepus Proprietary Trading

- Aug 15, 2025

- 4 min read

If you have been trading for a while, you will know markets are unpredictable. They do not follow perfect patterns. Sometimes they react, sometimes they ignore what you think should matter. Then they spike or collapse out of nowhere. That is not bad luck, that is how the system works.

Trading is a non-deterministic system. That means there is no fixed path. It is based on probability, not certainty. And like other chaotic systems, it has a few key components we need to understand if we want to trade it properly.

Here are the three main ones.

1. Minute Initial Conditions

This is the idea that small inputs can lead to big outcomes.

In trading, that is your entry. Where you place the trade, when you enter & how much size you take. It all sets the path in motion. But the market will not repeat itself the same way next time, even if it looks like the same setup.

This ties in closely with Wyckoff’s theory, which teaches that although markets move in familiar phases such as accumulation, markup, distribution, and markdown, they never repeat precisely. Each move is shaped by a different mix of participants, effort, and outside events. Wyckoff emphasised that traders must focus on understanding cause and effect, rather than simply chasing recurring patterns.

2. Orbital Movements

Markets move in cycles. They swing up and down over time. It is not a straight line. These movements can look similar, but they are always a little different.

This is where technical traders focus. They try to catch the swing from one price level to the next. And in many cases, it works. But these cycles never repeat with exact timing, speed, or shape. You can be right one day and completely off the next, even if you took the same kind of trade.

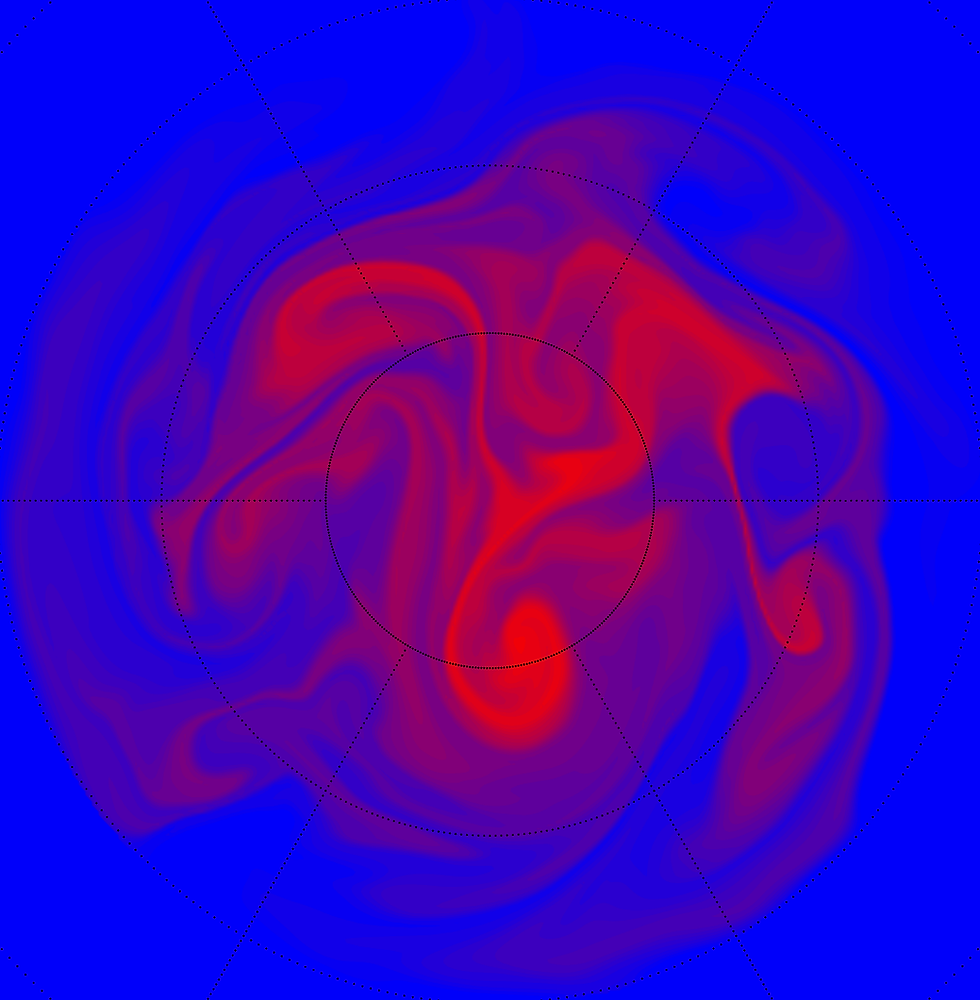

3. Topological Mixing

Now this is the one most traders miss, and it is the one that causes the most damage.

Topological mixing is the idea that, given enough time, everything in the system blends together. You lose track of structure. Predictability fades.

Imagine you are mixing white and black paint. At first, you can still see streaks of both colours. But the more you stir, the more it turns into grey. Eventually, it becomes one colour and you cannot separate it anymore.

Markets work the same way. In the short term, you can see clear setups. Supply and demand zones. Breaks of structure. Clean moves. But the longer you stay in the trade, the more chance that outside information comes in and changes the whole picture. That is when structure breaks down and randomness takes over.

How Long Do You Have Before It All Turns Grey?

This is where something called Lyapunov time comes in. In simple terms, it is the amount of time you have before the system becomes unpredictable.

In trading, we call that T. T is simply a function of time, the window between your entry and when new information enters the market. That new information can be anything; a large order, speech from a politician, an interest rate decision or even a natural disaster.

Once T is up, the whole market can change direction. And if you are still holding the trade based on your original setup, you are now trading in grey paint. Your edge is gone.

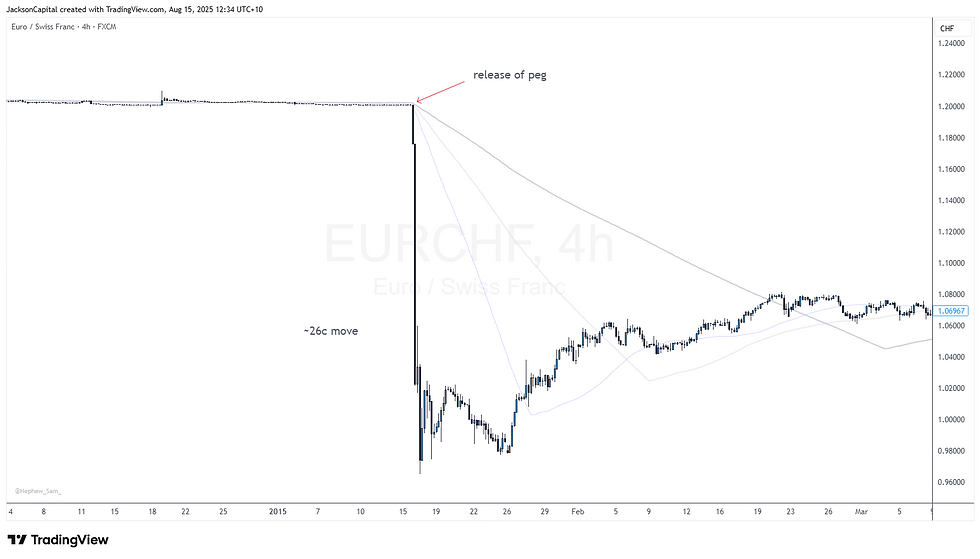

A good example is when the Swiss National Bank unpegged the franc from the euro on 15 January 2015. The day before, they told the market they were committed to the peg. The next day, they removed it. That one action blew up trading accounts around the world. Brokers went bankrupt. That is how fast chaos can hit.

How to Trade in a Chaotic System

It is all about knowing the environment you are in, and adjusting to it.

If volatility is high, trades will move faster, but they also become more unpredictable sooner. You shorten your trade duration, widen your stops, and reduce your size.

If the market is calm and waiting on news, you trade the range, or you stay out altogether until the event passes. If you know news is due in three hours, then your trade may need to be finished before that. Or at the very least, you scale it back and manage your exposure.

Quick Reference Table

Component | Trading Equivalent | What You Do |

Minute initial cond. | Trade entry | Be precise, but accept that it will never be perfect |

Orbital movements | Price swings and structure | Trade them, but do not expect the same result each time |

Topological mixing | Loss of structure over time | Do not overstay your trade, your edge fades the longer you hold |

Lyapunov time (T) | Time before randomness takes over | Be aware of the clock and upcoming news, adapt or exit early |

Final Thoughts

Trading is not about being right all the time. It is about knowing when your edge is strong, and when it is fading. The system you are in is chaotic. It rewards discipline and punishes stubbornness.

If you want to stay sharp, trade inside your edge, and get out before the paint turns grey.

Most short-term traders win because they stay within their edge and that edge exists in the early part of the trade, when price structure is still intact. The longer you hang on, the more chance randomness takes over.

Your job as a trader is to adjust to the environment.

If volatility picks up, shorten your trades. If the market ranges before news, trade range setups. And if there's big news due in 3 hours? Adjust. That’s the job.

EXCELLENT post. Thanks! I'm printing this out and putting it above my computer screen.