USDX has made a Gartley pattern

- Lepus Proprietary Trading

- Feb 27, 2019

- 1 min read

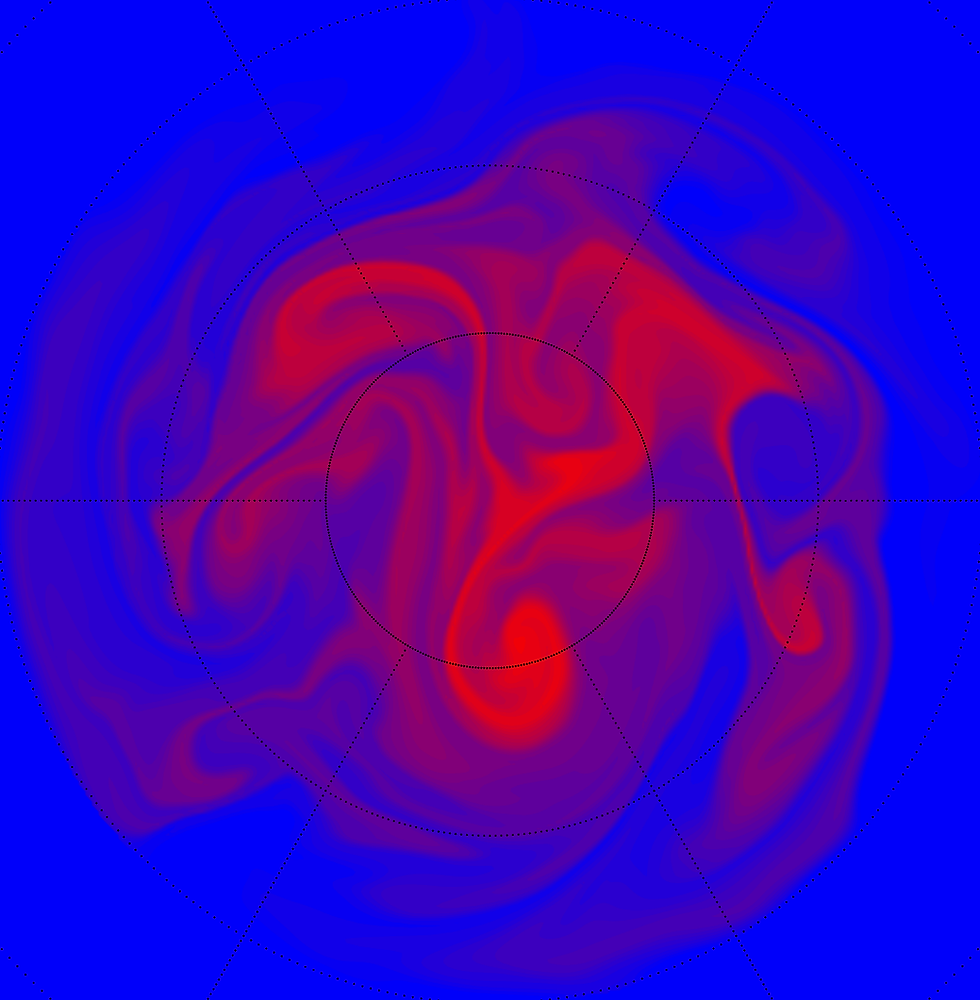

H.M. Gartley’s 1935 book Profits in the Stock Market describes patterns and technical analysis techniques. The standout pattern illustrated was on page 222. Hence the nickname ‘Gartley’s 222 pattern’. It shows the AB=CD pattern and expresses a classic retracement area which rises to an overall trend continuation or reversal. Today’s tidied variation of the pattern includes point x to the shape in which the ABCD legs are within the boundaries of the XA leg. The Gartley characteristics between the points are:

Point B and D cannot exceed point X

Point C cannot exceed point A

0.618 B from XA

0.786 D from XA

1.272; 1.618 of BC

AB= CD

0.382; 0.886 C from AB

Please see that the Gartley has come after the 5th leg of Elliott and is part of the ABC retracement.

Comments