Cosmos & Chaos - Trading the Financial Markets

- Lepus Proprietary Trading

- Feb 28, 2020

- 4 min read

Chaos from Greek cosmogony for the primordial state before creation is considered a time void of form. Later, in Elizabethan times, to mean "complete disorder or confusion".

Cosmos refers to heavenly bodies and their predictable movement across the sky, originally derived from Greek cosmogony for the period after genesis. This refers to the change from chaos to order: cosmos.

We know from the brilliant work of Copernicus (On the Revolutions of the Heavenly Spheres 1543) that the heavens move in a very predictable fashion and there is a reason for the irregular orbit of planetary bodies. This is an observed fact and the first major move away from fiction, a geocentric and widely accepted religious view, to creating an explanation of observation, a heliocentric solar system.

Because we live in this cosmos we understand the things around us to be forever ordered. For example, if I drop a stone from a cliff I know the acceleration is 9.8 meters per second squared. If I return the next day, the effect of the push of space (Gravity) on the stone will be exactly the same.

As Carl Sagan said, “Cosmos is a Greek word for the order of the universe. It is, in a way, the opposite of Chaos. It implies the deep interconnectedness of all things. It conveys awe for the intricate and subtle way in which the universe is put together.”

Newton, a pioneer in the understanding of order, created a language (Calculus) to describe a part of the intelligent design around us. Although not alone in its creation, it is a language to describe order and is set forever in time as a way to describe change. Although later, some of Newton’s ideas where surpassed, specifically, Newton’s theory of Universal Gravitation replaced by Einstein’s theory of General Relativity. However, we must remember these descriptions are just that; descriptions. A way that human intelligence can describe intelligent design. The human race still has a long way to go in perfectly describing all things.

Humans love to live in this certain 3-dimensional world. After all this is where we have grown up. Imagine living in a world where there is no certainty. A place where my reality is completely different to yours. We would not be able to communicate, interact or function at all. What I call a dog you call a cat and the next person has never seen such a creature.

A predictable and certain existence is a comfortable place for us. We love to know that when we wake up in the morning our toast is going to taste the same, know that when we get in our car it drives us to work and when we come home we know we are going to be paid for the day.

However, when scaling down to the subatomic level the certainty and laws that govern the world we are all used to do not exist. To understand this level of nature, laws break down and therefore the only way to grasp the very small is to quantify the outcome. This level of physics is called quantum mechanics and the only way to know the outcome of the position of an electron or photon of light is based on probability and not an irrefutable law. Einstein had a complete belief in the order of things and did not like the idea of quantum mechanics as he said “God does not like to play dice”. However, there needs to be a way to describe this disorderly environment.

Weather is such a mechanism that only probability can predict. However, we all know that it is simply a guess and not a certainty. I am sure you have read on you weather app on your phone the chance of a weather event happening. For example, a 35% chance of rain. Even with the greatest minds and sophisticated computing today we can only predict the weather a few days out. Called Lyapunov time, it is the limit of predictability. It is the time scale on which a dynamical system becomes chaotic or unpredictable. For example, try predicting the weather 6 months or even 1 year from now. This is impossible. Why?

Weather is formed from slight changes in temperature in oceans and land. A miniscule change can have a wider effect on the overall outcome. This is called the butterfly effect and was first brought to light by American mathematician Edward Lorenz in 1972 when he presented a paper titled “Does the Flap of a Butterfly’s Wings in Brazil Set Off a Tornado in Texas?” (Sardar, 2005). Lorenz promoted that a single flap of a butterfly’s wings would have enough of an impact in atmosphere and weather patterns to eventually cause a tornado in a different part of the world. In other words, there is sensitive dependence on the initial conditions to create larger differences in the later state.

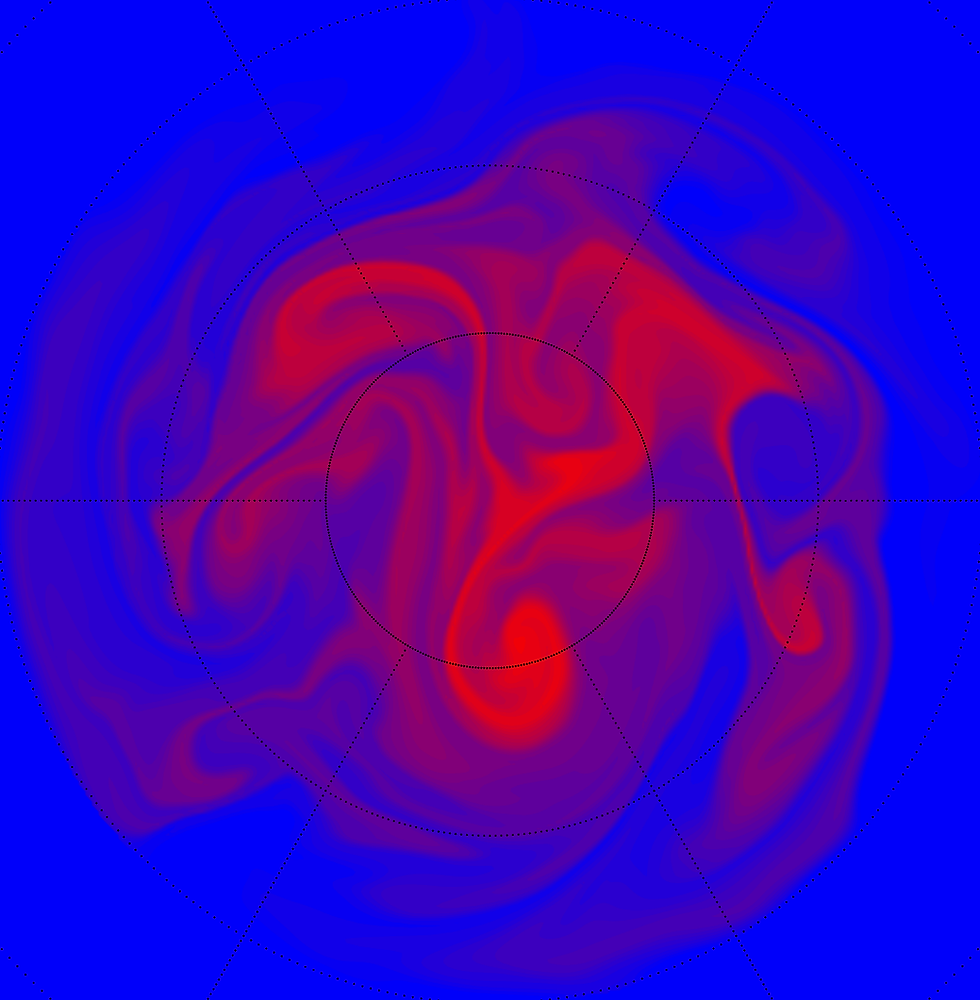

However, the butterfly effect or sensitivity to initial conditions alone is not necessarily chaos. It is just one component of chaotic dynamics. Chaotic dynamics states; there also needs to include; topologically mixing, like the mixing of different coloured paints or additional contributions to the process and although not entirely necessary, dense periodic orbits, which in layman's terms means a repeating system that will cycle through similar behaviour however when sampling a state of the system, it’s fixed path is unpredictable.

How does this all relate to the financial markets? As stated earlier, the markets are chaotic by nature. If you truly want to succeed in the financial markets, you need to not only understand this chaos, but find order within it.

Comentários