Trading in the Tunnel: Understanding Cognitive Tunneling, Yerkes-Dodson Law, and Flow State

- Lepus Proprietary Trading

- Jun 14, 2025

- 3 min read

In the high-stakes world of day trading, where every second counts, understanding the psychological underpinnings of our decisions is as crucial as any technical analysis. Among these psychological concepts, cognitive tunneling, the Yerkes-Dodson Law, and the flow state play pivotal roles in shaping our trading performance.

The Perils of Cognitive Tunneling

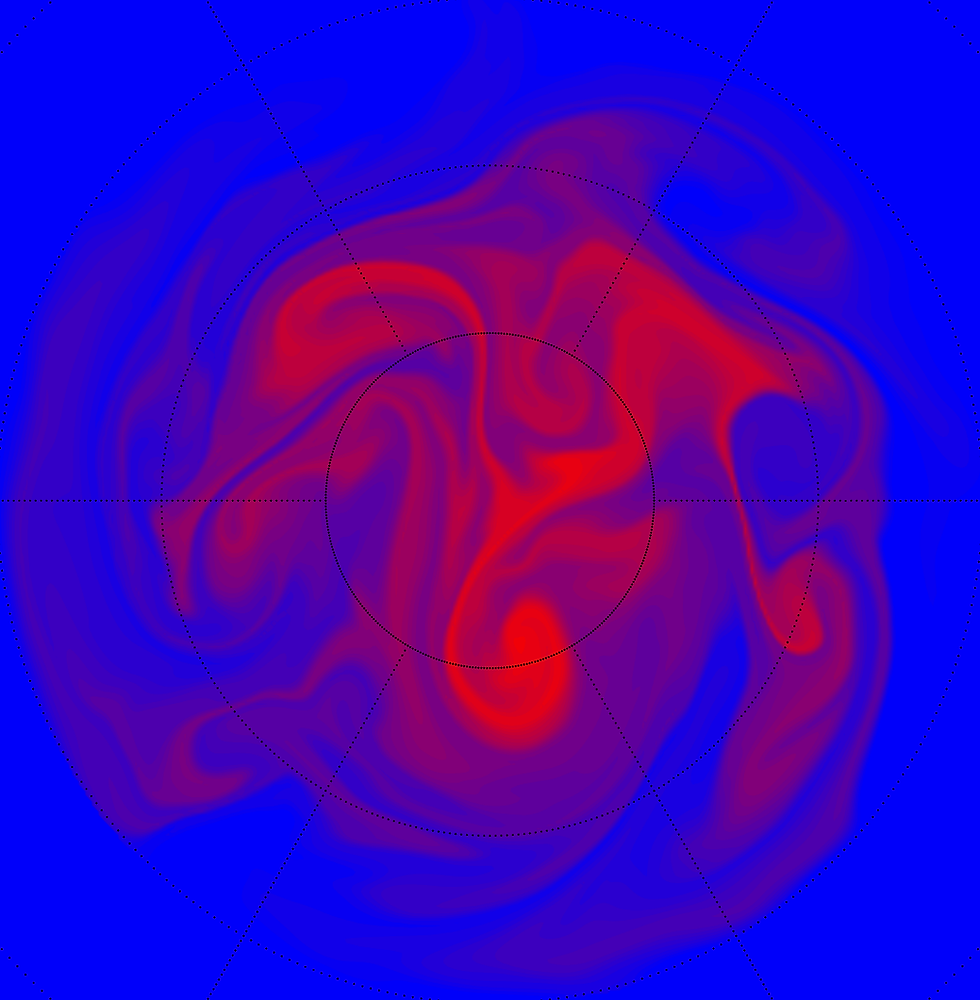

Cognitive tunneling refers to the phenomenon where, under stress, our attention narrows, causing us to focus intensely on a specific aspect of our environment while neglecting other critical information. In trading, this often manifests when a trader fixates on a lower time frame chart during volatile market conditions, losing sight of the broader market context provided by higher time frames like the 15-minute or 4-hour charts.

This narrowed focus can lead to premature decisions, such as moving stop-loss orders too soon or missing key support and resistance levels. It's akin to wearing horse racing blinkers—your peripheral awareness diminishes, and you become susceptible to making decisions based on incomplete information.

The Yerkes-Dodson Law: Balancing Stress and Performance

The Yerkes-Dodson Law, introduced by psychologists Robert Yerkes and John Dodson in 1908, illustrates the relationship between arousal (stress) and performance. The law posits that performance improves with increased arousal up to an optimal point, beyond which further stress leads to a decline in performance.

For traders, this means that a certain level of stress can enhance focus and decision-making. However, excessive stress can push us into a state of cognitive overload, impairing our ability to process information effectively and leading to errors in judgment.

The Flow State: Optimal Trading Performance

Psychologist Mihaly Csikszentmihalyi introduced the concept of the flow state, a mental state where individuals are fully immersed and engaged in an activity, experiencing heightened focus and enjoyment. Achieving flow requires a balance between the challenge of the task and the individual's skill level.

In trading, entering a flow state allows for seamless execution of strategies, where decisions are made intuitively and efficiently. However, reaching this state necessitates confidence in one's trading plan, emotional regulation, and the ability to maintain a broad situational awareness to avoid the pitfalls of cognitive tunneling.

A Cautionary Tale: Air France Flight 447

The tragic crash of Air France Flight 447 in 2009 serves as a stark reminder of the dangers of cognitive tunneling. When the aircraft's autopilot disengaged due to ice crystals blocking the pitot tubes, the pilots faced a sudden and unfamiliar situation. Under stress, they focused intently on specific instruments, neglecting other critical cues.

One pilot fixated on the primary flight display, pulling back on the control stick and causing the aircraft to climb until it stalled. Despite multiple stall warnings, the crew failed to recognize the situation and take corrective action. This incident underscores how stress-induced tunnel vision can lead to catastrophic outcomes when situational awareness is compromised .

Reflective Questions for Traders

To mitigate the risks associated with cognitive tunneling and maintain optimal performance, consider the following:

Am I aware of the broader market context, or am I fixated on a single time frame?

Is my current stress level enhancing or impairing my decision-making?

Am I following my trading plan, or reacting impulsively to market movements?

What strategies can I employ to maintain situational awareness during high-stress periods?

Strategies for Maintaining Optimal Performance

Multi-Time Frame Analysis: Regularly consult higher time frame charts to understand the broader market trends and key support/resistance levels.

Stress Management Techniques: Incorporate practices such as deep breathing, mindfulness, or brief breaks to regulate stress levels during trading sessions.

Pre-Trade Checklists: Utilize checklists to ensure all aspects of your trading plan are considered before entering a trade.

Post-Trade Reviews: Analyze your trades to identify instances of cognitive tunneling and develop strategies to prevent recurrence.

Continuous Education: Stay informed about psychological concepts affecting trading performance to enhance self-awareness and decision-making.

Understanding and integrating these psychological principles into your trading practice can significantly enhance performance and resilience. By maintaining situational awareness, managing stress effectively, and striving for the flow state, traders can navigate the complexities of the market with greater confidence and precision.

Comments