Impact on Oil and Gold - Israel Palestine conflict

- Lepus Proprietary Trading

- Oct 9, 2023

- 2 min read

Watch the first 10min

References:

https://www.bbc.com/news/business-67050612

https://www.bloomberg.com/news/articles/2023-10-09/israel-latest-over-1-100-dead-oil-soars-on-fears-of-proxy-war?srnd=premium-asia

Over the weekend, a significant event unfolded, similar to the intervention with the Yen. While we have a good grasp of events scheduled on our calendar, such as the NFP on Friday, we don't know about unknown events, this one being geopolitical. (I've done a video on the YEN intervention on another blog.)

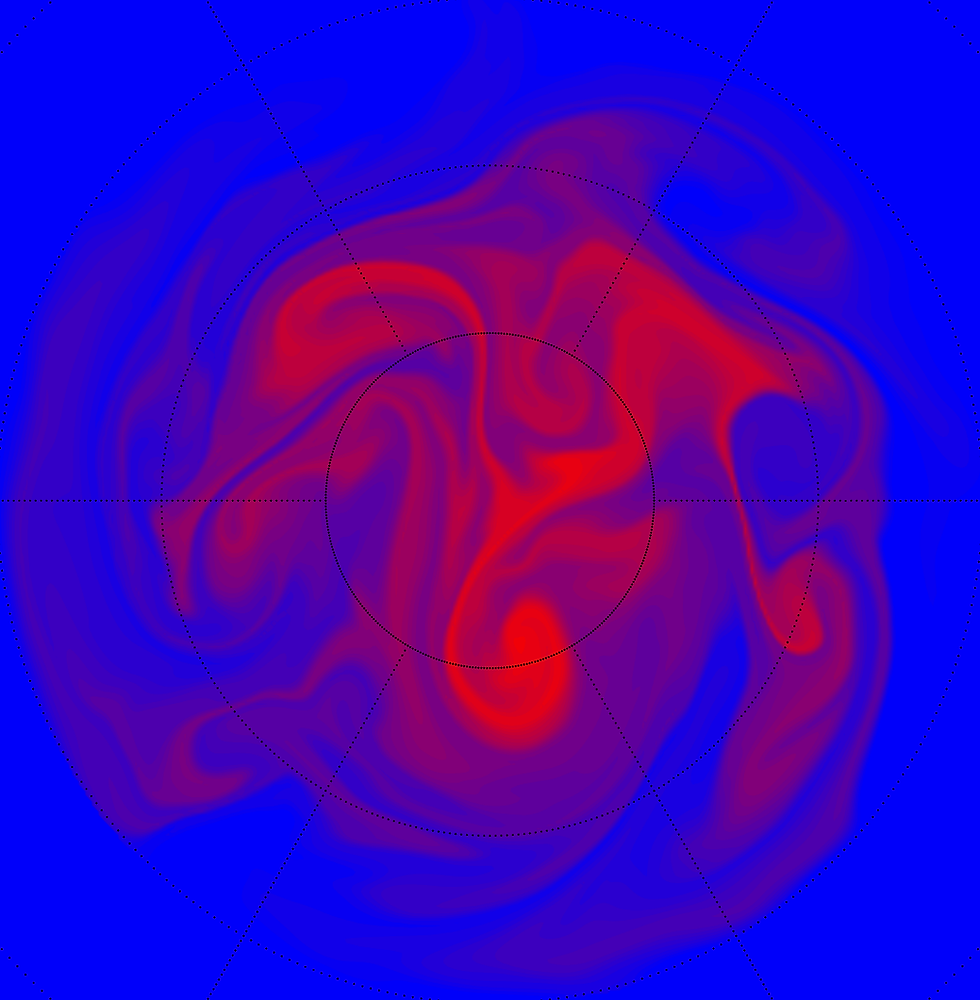

For example, the current escalation of tensions between Israel and Hamas has had speculative consequences, notably for commodities such as oil and gold. Such occurrences have the potential to have far-reaching implications, particularly if they disrupt global supply systems. This emphasises the significance of remaining informed about global events that may have an impact on our daily lives.

Force majeure events, such as earthquakes and tidal waves, can also significantly alter supply and demand dynamics in various countries. Currently, the focus is on the situation involving Hamas, but it's essential to keep in mind that events like these can create ripple effects in financial markets.

The most important lesson is that geopolitical developments require our attention. Although they may not have an immediate effect, conflicts like the one between Israel and Hamas can still spark rumours that have an impact on commodities like oil. In this case, what worries us more than the actual conflict is the rumour that Iran may blockade the Strait of Hormuz as a result of its support for Hamas. Oil prices would probably increase if there were a blockade.

In order to keep ahead of market changes as we negotiate such occurrences, it's essential to proactively obtain information from dependable sources like BBC News, WSJ, Reuters, CNBC, and Bloomberg. Even though we may not be oil traders, being aware of the repercussions enables us to make wise choices.

Shifting our focus to market indicators, we observe gaps in both oil and gold prices. These gaps often tend to close over time, but the pace depends on the underlying news. Additionally, gold tends to rise in times of market uncertainty, making it a safe haven asset.

In recent developments, gold has spiked due to the uncertainty caused by the weekend's events and ongoing geopolitical tensions. Therefore, it's essential to monitor these situations closely, especially the relations between the U.S. and Iran.

In conclusion, as traders, it is our responsibility to stay informed about global events and understand their potential impact on financial markets. We must diversify our sources of information and consider multiple perspectives to make well-informed decisions. While we are aware of the recent events, it's crucial to remain vigilant and adapt our strategies accordingly in this ever-changing landscape.

Comments